35+ reverse mortgage capital gains tax

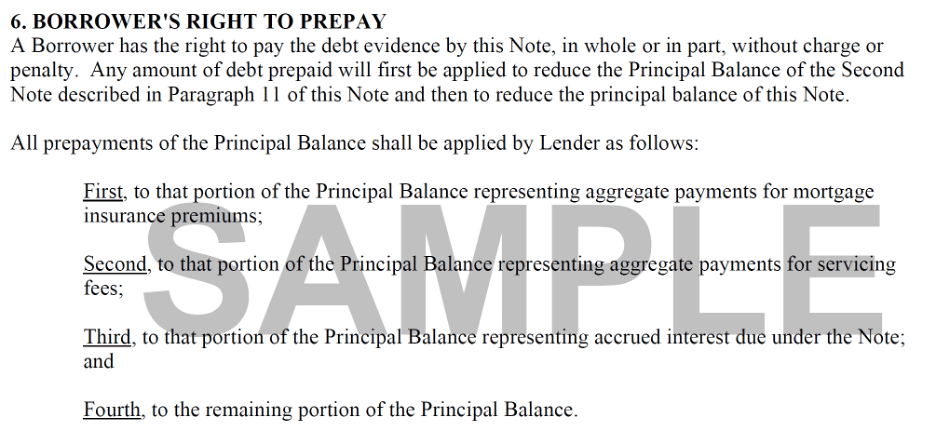

Reverse mortgage payments are considered loan proceeds and not income. Long-term capital gains are gains.

Is A Reverse Mortgage Taxable Income What You Need To Know

Many people qualify for a 0 tax rate.

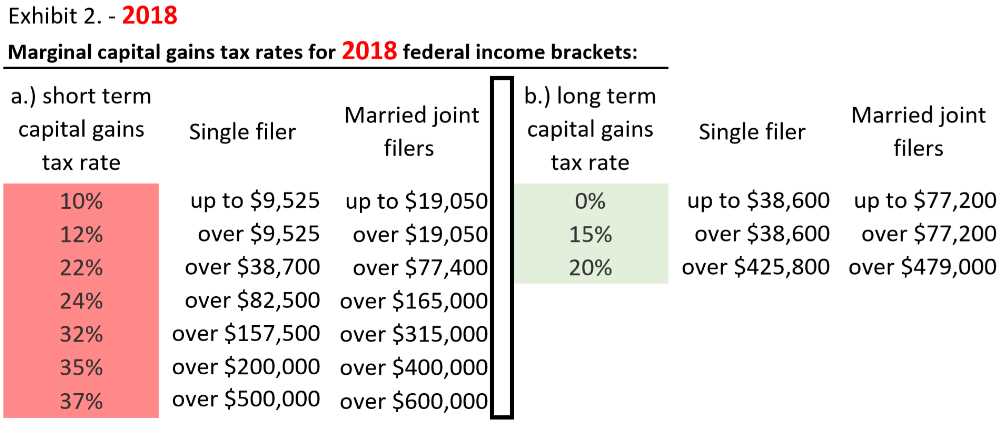

. Web Long-term capital gains tax rates typically apply if you owned the asset for more than a year. Web The tax rate you pay on your capital gains depends in part on how long you hold the asset before selling. Web The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

Web This value is double for married people filing jointly. Taxes capital gains as. Web He illustrated ways in which capital gains could interact with a reverse mortgage for purchase by constructing a hypothetical scenario.

Web Calculating Capital Gains on a Property Sale Subtract the total amount you originally paid for the property at purchase from the total sale price of the property. Web How much you owe depends on your annual taxable income. Capital gains taxes on assets held for a year or less correspond to ordinary.

Ask a Business Expert This and More Right Now in a Chat. The amount you realize on the sale of your home and the adjusted basis of your home are important in determining whether youre subject. Idaho axes capital gains as income.

Web The long-term capital gains tax rates for the 2022 and 2023 tax years are 0 15 or 20 of the profit depending on the income of the filer. Web No reverse mortgage payments arent taxable. The rates are much less onerous.

The taxes will be on the appreciation that is above this point. Web Up to 25 cash back A reverse mortgage is a special type of home loan designed to enable homeowners 62 years of age and older to access part of the equity in their homes. Web Taxes capital gains as income and the rate reaches 575.

With this if you bought your home for 350000 and sold it for. Taxes on Long-Term Capital Gains. If the property purchased.

The rate reaches 693. Web Short-term capital gains are also taxed at your regular tax bracket or your ordinary tax rate. Youll pay a tax rate of 0 15 or 20 on gains from the sale of most assets or investments held for.

Ad Ask a Capital Gains Expert About Taxes Laws Assets and More Online Right Now. Short-term capital gains are taxed as ordinary income at rates up to. How Are Capital Gains Taxed.

The lender pays you the.

Is A Reverse Mortgage Taxable Income What You Need To Know

What S New For 2018 Hawaii Real Estate

Jul 5 2012 Herald Union By Advantipro Gmbh Issuu

How To Deduct Reverse Mortgage Interest Other Costs

Murray Journals June 2022 By The City Journals Issuu

Pdf The Income Concept In Eu Silc Relevance Feasibility Challenges

Reverse Mortgages And Taxes

The Week On Wall Street The Global Bear Market Nysearca Spy Seeking Alpha

Cayman Resident 2023 By Acorn Media Issuu

The Tax Implications Of Reverse Mortgages Newretirement

Maryland Student Loan Forgiveness Programs

Tapping Into Home Equity The Better Bet In Today S Economic Climate Canadian Mortgage Professional

Constructiveness Toxicity Corpus Sfu Constructiveness Toxicity Csv At Master Sfu Discourse Lab Constructiveness Toxicity Corpus Github

Bond Market A Tad Antsy About Inflation Not Just Vanishing One Year Yield Nears 5 Mortgage Rates Back At 6 5 Wolf Street

Wdc3995541 Def14a1x1x1 Jpg

The Bush Capital Gains Tax Cut After Four Years More Growth More Investment More Revenues

June 28 2012 The Citizen By Advantipro Gmbh Issuu